Latest security alerts

Stay up to date with the latest alerts and take steps to safeguard your personal and banking information.

Stop. Check. Protect.

Three simple steps to keep your money and identity safe:

Stop

Check

Confirm before you act. Use official contact details to verify the request or ask someone you trust for advice.

Protect

If it’s suspicious, secure your accounts. Change passwords, enable multi-factor authentication, and report the scam to Police Bank.

Scam safety

Scams are becoming more common across Australia as technology makes it easier for scammers to convince their targets to hand over money or sensitive information.

Your best protection against these scammers is to detect suspicious activity early.

Red flags to watch out for

There are several indicators that something could be a scam. Here are some common warning signs to watch out for:

- You don’t know or recognise the person asking for money or personal details.

- The deal or offer you’ve received seems ‘too good to be true’ – in most cases, it is.

- You’re being pushed to click on a link or open an attachment.

- The ‘business’ you’re dealing with isn’t correctly registered when you check its details on ABN Lookup.

- You’re asked to open new accounts or create a new PayID.

- You’re asked to make a payment using an unusual or specific methods (for example, by supplying gift vouchers or using cryptocurrencies). These requests and behaviours are typical of a scam.

We’ll never ask you to:

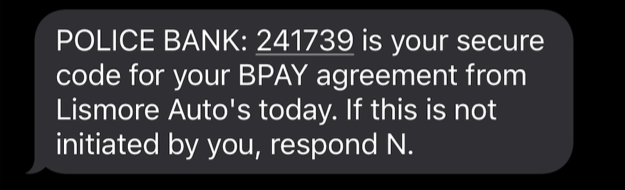

- Share sensitive details including passwords, your pin, or a one-time passcode.

- Click a link to log into your account.

- Grant remote access to your computer, phone, or tablet.

- Transfer money to another account to keep it safe.

Please take a minute to read about some of the most common scams below and what you should look out for.

Common scammer tactics

Scammers use a range of strategies to try forcing their targets into making a mistake. Below are some of the techniques they may use to trick you.

Asking for personal details

Scammers will try to get you to reveal personal details including bank account details and passwords.

They may also ask for seemingly mundane information like the names of your pets or where you grew up (hoping to get answers to your security questions).

They may even impersonate bank staff or IT support personnel to trick you into sharing information.

Police Bank will never ask you for account details, your PIN or your passwords, and you should never share this information with anyone.

If you have received a suspicious phone call, email or SMS link, make sure you:

Safer, more secure passwords

Your password is the first line of defence against scams and fraud. The stronger it is, the better protected your accounts and personal information will be.

To help keep you safe, we recommend using a password that includes both uppercase and lowercase letters, numbers and special characters.

Stronger passwords make it harder for scammers to access your information and are a simple but effective way to stay protected online. Head over to Settings in your Mobile Banking App or Internet Banking to strengthen your password today.

Police Bank will never ask for your password or security codes by email, phone or SMS. If something doesn’t feel right, stop and contact us directly.

Some tips to create a safe password

- Avoid anything that’s easily guessed such as your address or birthday.

- Don’t share your passwords with anyone.

- Don’t write your passwords down anywhere.

- Make your passwords unique – reusing a password makes it less secure.

Spot the most common scams

Learn about the most common scams out there so you can avoid them.

If you suspect a scam, please contact us on 131 728

For more information about online scams and staying safe visit

Related articles

Scams Awareness week

With most scams involving a form of impersonation, Scamwatch is warning Australians and are urging you take additional precautions towards who you’re dealing with this November.

Protecting your kids from scams

Scammers go after all sorts of Australians, including children and teenagers. Here are some of the scams targeting young people – and what you can do to shield them from danger as they go back to school.

Tax scams to watch out for

Many of our members can spot crimes quickly, but sometimes it helps to get an update on the types of scams doing the rounds. Here are a few things to keep on the radar at tax time.

More helpful information

Fighting fraud

Each year more than one million Australians are the victims of fraud. On this page, Police Bank can teach you how to identify the signs and keep yourself safe when making transactions online.

Confirmation of Payee

To help protect our members from fraud, scams and mistaken payments, we’ve launched Confirmation of Payee (CoP) — a new security feature that adds an extra layer of protection when you’re sending money.

Lost or stolen cards

If your card has been lost or stolen, it’s important to act quickly to protect your account and prevent any unauthorised transactions.