Latest security alerts

Stay up to date with the latest alerts and take steps to safeguard your personal and banking information.

We’ll never ask you to:

- Share sensitive details including passwords, your pin, or a one-time passcode.

- Click a link to log into your account.

- Grant remote access to your computer, phone, or tablet.

- Transfer money to another account to keep it safe.

Please take a minute to read about some of the most common scams below and what you should look out for.

If you have received a suspicious phone call, email or SMS link, make sure you:

Safer, more secure passwords

Your password is the first line of defence against scams and fraud. The stronger it is, the better protected your accounts and personal information will be.

To help keep you safe, we recommend using a password that includes both uppercase and lowercase letters, numbers and special characters.

Stronger passwords make it harder for scammers to access your information and are a simple but effective way to stay protected online. Head over to Settings in your Mobile Banking App or Internet Banking to strengthen your password today.

Police Bank will never ask for your password or security codes by email, phone or SMS. If something doesn’t feel right, stop and contact us directly.

Some tips to create a safe password

- Avoid anything that’s easily guessed such as your address or birthday.

- Don’t share your passwords with anyone.

- Don’t write your passwords down anywhere.

- Make your passwords unique – reusing a password makes it less secure.

If you suspect a scam, please contact us on 131 728

Digital banking security

Our website and Internet Banking platform use SSL encryption to safeguard your personal information. In addition, you are further protected by leading firewall technology and our online security token system. We are providing an extra layer of protection for your Internet Banking and Mobile Banking App. We may send you an SMS OTP (One Time Password) to verify a range of online banking services such as Pay Anyone payments and forgotten passwords.

An OTP is a single use passcode valid for only one online banking activity sent to the mobile phone number we have on our records to confirm the online banking activity. Simply enter the OTP to complete your action. Please do not disclose this code to anyone.

Spot the most common scams

Phishing

Phishing is when scammers impersonate trusted entities like banks, telcos or even official government agencies like the ATO, targeting individuals through emails, phone calls, or text messages. They can look and sound legitimate and use tactics such as technical error, unauthorised activity, customer survey, security update or money to be paid to you, to trick you into sharing sensitive information such as passwords, usernames, and bank account information.

If you suspect a scam, please contact us on 131 728

For more information about online scams and staying safe visit

Related articles

Scams Awareness week

With most scams involving a form of impersonation, Scamwatch is warning Australians and are urging you take additional precautions towards who you’re dealing with this November.

Read more

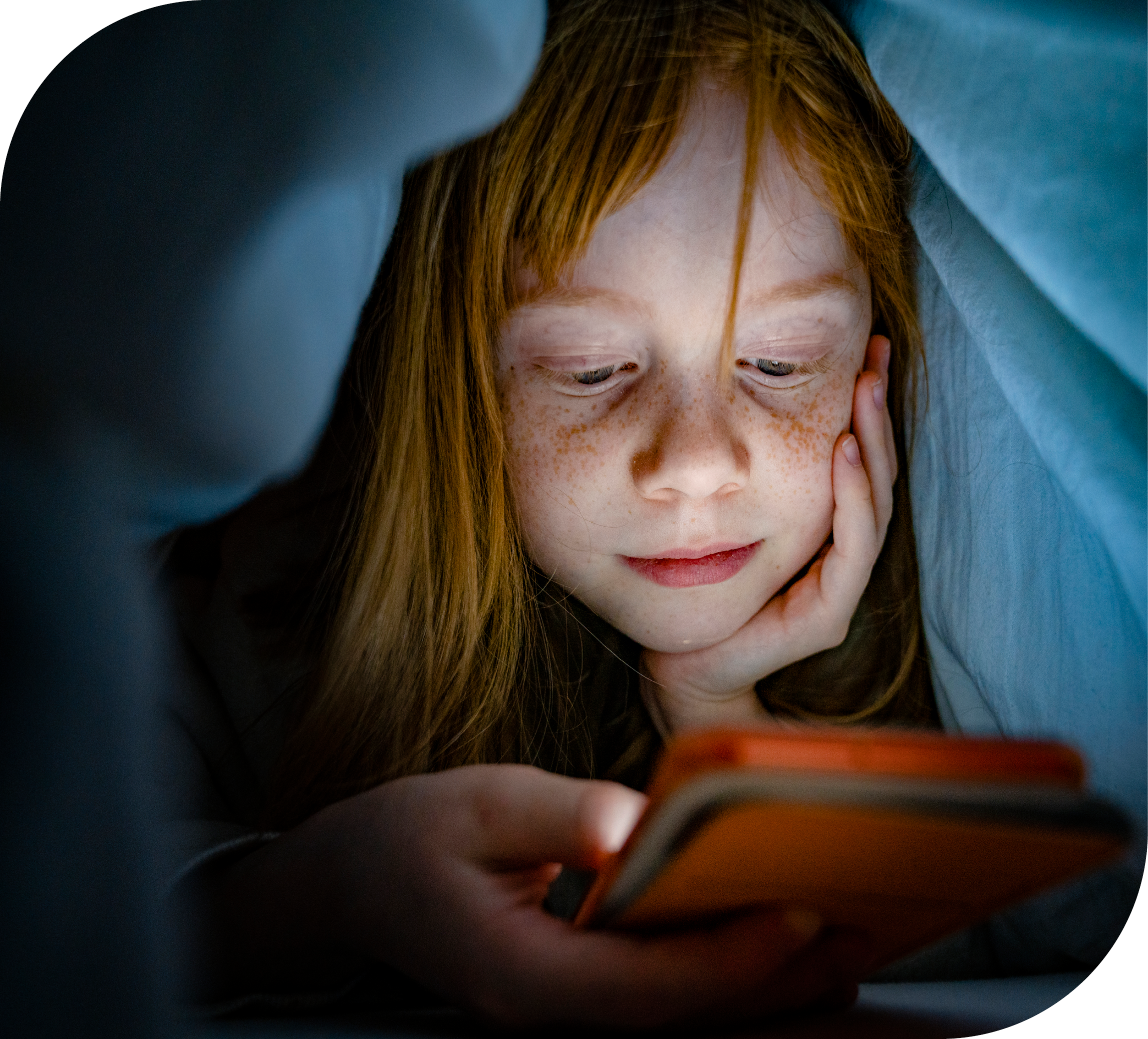

Protecting your kids from scams

Scammers go after all sorts of Australians, including children and teenagers. Here are some of the scams targeting young people – and what you can do to shield them from danger as they go back to school.

Learn more

Tax scams to watch out for

Many of our members can spot crimes quickly, but sometimes it helps to get an update on the types of scams doing the rounds. Here are a few things to keep on the radar at tax time.

Read more